Coin-margined Futures Trading Fees

- Policy Statement

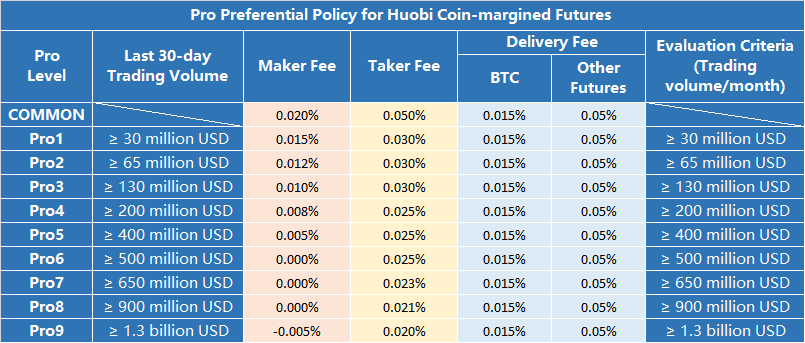

After becoming a Pro (professional) client of HTX coin-margined futures, you could enjoy a preferential fee rate. Email us through [email protected].

For details of Pro, please check: Preferential Policy for HTX Coin-Margined Futures Pro Clients>>>

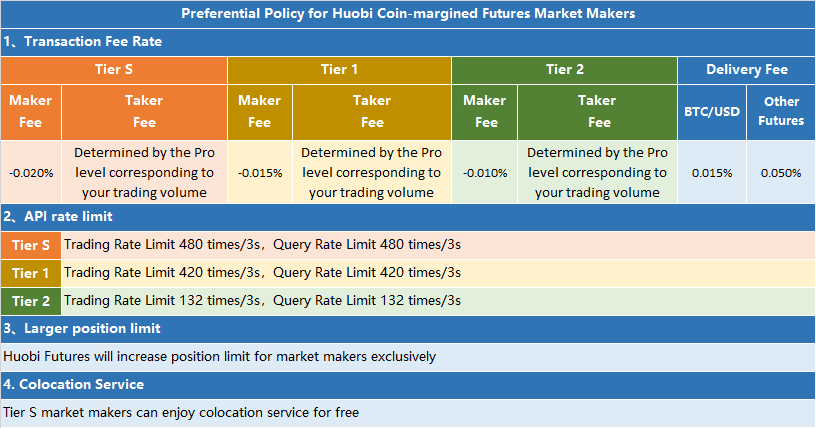

After becoming a market maker of HTX coin-margined futures, you could enjoy a preferential fee rate. Email us through [email protected].

For details of Taker Fee, please check:HTX’s PRO Sharing Program

For details of Market Maker, please check: HTX Coin-Margined Futures Market Maker Preferential Policy >>>

To experience Pro fee rate:

1. “Deposit to Become a Pro” activity: Users with converted asset value equal to or greater than 100,000USD could apply for a Pro fee rate. For application details, please click>>>

| Converted Value of the Assets (USDT) |

Pro Level |

| ≥100,000 |

Pro1 |

| ≥200,000 |

Pro2 |

| ≥500,000 |

Pro3 |

| ≥1,000,000 |

Pro4 |

| ≥2,000,000 |

Pro5 |

| ≥3,000,000 |

Pro6 |

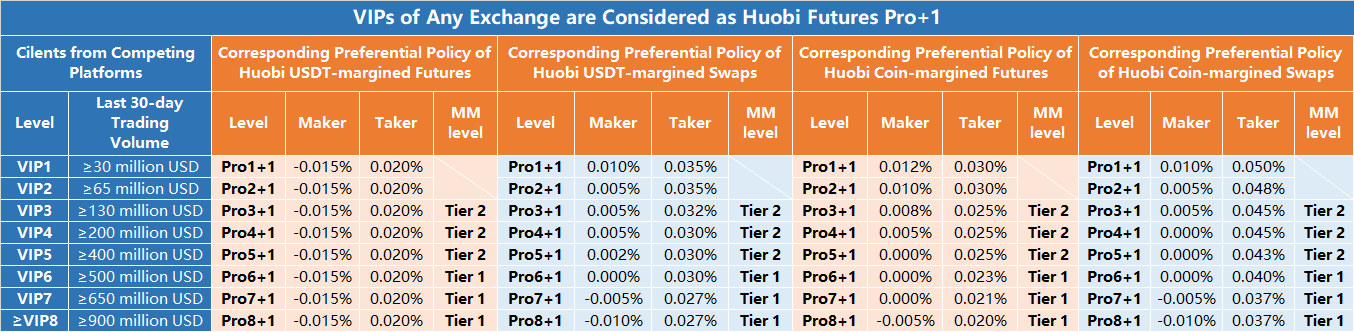

2. VIP Sharing Program. For application details, please click>>>

Users with converted asset value equal to or greater than 30,000 USD could apply for a Pro fee rate

Note:

- If there are any changes for transaction fees or effective date, please refer to the official announcement.

- Maker order: A maker transaction refers to placing a limit order which does not instantly be filled with the open orders in the order book, therefore the order will be placed in the order book and wait to be filled. A Maker order can only be finalized after a fully complete transaction. Maker trading increases the liquidity of the order book;

- When a user’s order takes the initiative to fill with the maker order you placed, you will pay the maker fees. (please note that if a user’s limit order is actively filled with the limit order you placed, but the order time is earlier than yours, you will have to pay the taker fee);

- Taker order: A taker transaction refers to placing an order by using the price selected from the order book and entering the quantity, then the order will be instantly filled with the order in the order book;

- If the order you placed takes the initiative to fill with another user’s maker order, you will have to pay the taker fees;

- A negative fee rate means no transaction fee will be charged, and the transaction fee paid will be refunded in real time.