Contract Leverage Introduction

- FAQ

HTX Futures support 1x-100x leverage. Before opening a position, users have to select a leverage. While holding a position, users can switch the leverage without no open orders.

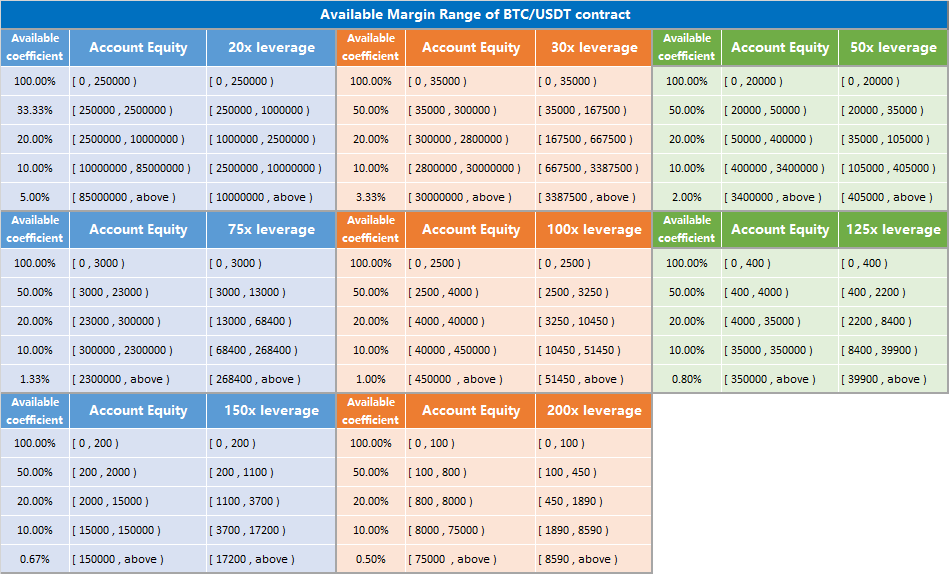

l Using leverage can magnify the principal, and affect available margin. Users are able to open a larger position to make more profits. Meanwhile, in order to maintain the stability of derivatives market and reduce the risks of large positions, when the account equity corresponding to the leverage used exceeds a certain range, the available margin will be restricted by the tiered margin mechanism.

*Take BTC/USDT contract as an example (face value= 0.001BTC/cont):

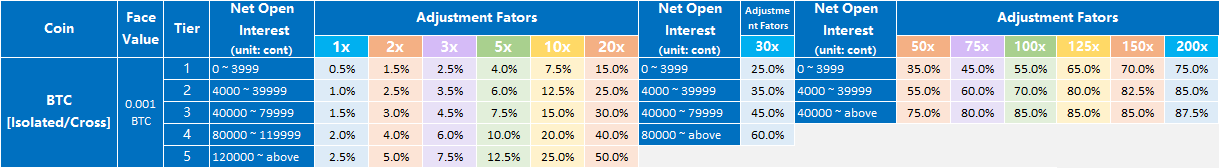

>>>Refer to Tiered Adjustment Factors of HTX USDT-Margined Contracts

Example 1: Tom has 100 USDT of equity in BTC/USDT swaps account, and the last price is 50,000 USDT, then;

When Tom uses 1x leverage, the available amount (cont) = 100 * 1 / 50,000 / 0.001 = 2 conts;

When Tom uses 5x leverage, the available amount (cont) = 100 * 5 / 50,000 / 0.001 = 10 conts;

When Tom uses 10x leverage, the available amount (cont) = 100 * 10 / 50,000 / 0.001 = 20 conts.

Example 2: Tom has 100,000 USDT of equity in BTC/USDT swaps account, and the last price is 50,000 USDT, then;

When Tom uses 30x leverage, the available coefficient is 50%, the available margin = 35,000+(100,000-35,000) * 50% = 67,500 USDT; and the available amount (cont) = 67,500 * 30 / 50,000 / 0.001 = 40,500 conts.

When Tom uses 50x leverage, the available coefficient is 20%, the available margin = 50,000 + (100,000 - 50,000) * 20% = 60,000 USDT; and the available amount (cont) = 60,000 *50/50,000/0.001 = 60,000 conts.

When Tom uses 100x leverage, the available coefficient is 10%, the available margin = 40,000 + (100,000 - 40,000) * 10% = 46,000 USDT; and the available amount (cont) = 46,000 * 100 / 50,000 / 0.001 = 92,000 conts.

It can be seen that the available margin will not increase when users use larger leverage. The available margin will depend on the tiered margin mechanism, subject to account equity, leverage, etc.

l Position data such as position margin, margin ratio and PnL ratio will be affected by switching leverages when holding positions, but the actual profits will not.

* Take a BTC/USDT contract as an example (face value= 0.001 BTC/cont):

>>>Refer to Tiered Adjustment Factors of HTX USDT-Margined Contracts

For instance, Tom has 1,000 USDT of equity in the isolated-margined BTC/USDT swaps and holds a long position of 100 conts with the entry price of 50,000 USDT. When the last price is 52,000 USDT, then:

①When Tom uses 5x leverage, the corresponding adjustment factor is 4.0%, then:

Position Margin = 0.001 *100 * 52,000 / 5 = 1,040 USDT

PnL = (52,000-50,000) * 100 * 0.001 = 200 USDT

PnL Ratio = 200 / (0.001*100*50,000/5) * 100% = 20%

Margin Ratio = (1,000 / 1,040) * 100% - 4.0% = 92.15%

② When Tom switches to 20x leverage, the corresponding adjustment factor s 15.0%, then:

Position Margin = 0.001 *100 * 52,000 / 20 = 260 USDT

PnL= (52,000-50,000) * 100 * 0.001 = 200 USDT

PnL Ratio = 200 / (0.001*100*50,000/20) * 100% = 80%

Margin Ratio = (1,000 / 260) * 100% - 15.0% = 369.61%

It can be seen that switching leverage will affect margin ratio for the adjustment factors change with the leverage at the same tier. When the position price is the same as the market price, the larger the leverage, the smaller the position margin, the higher the PnL ratio, but the actual PnL of the account will not be affected.

Please Note:

1. Leverage is only available to switch for contracts in trading status.

2. Leverage is unavailable to switch when users have open orders of a contract.

3. Users can only switch leverage to an available one at that time.

4. If the available margin of user’s account is less than 0 after adjusting the leverage, leverage is unavailable to switch.

5. If the margin ratio of user’s account is equal to or less than 0 after adjusting the leverage, leverage is unavailable to switch.

6. Leverage may fail to switch due to problems like non-trading status, insufficient margin, network problems, or system problems.